(New York Post) The nation’s largest banks got walloped Wednesday — showing they weren’t immune to the crisis that has hammered regional lenders — after Credit Suisse reignited fears of a contagion in global banking.

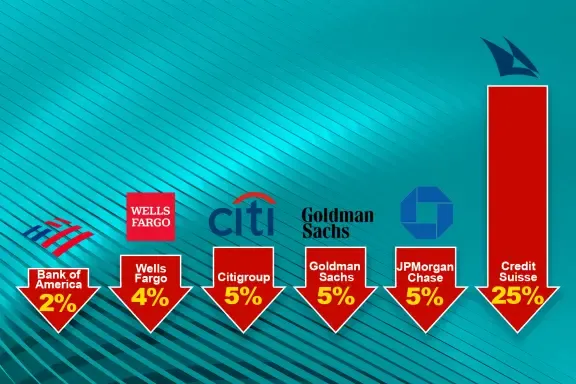

Shares of JPMorgan Chase and Citigroup slid more than 4%, while Wells Fargo and Goldman Sachs fell more than 3% and Bank of America sank 0.9%.

US banks got slammed as Zurich-based Credit Suisse plunged 24% after its biggest shareholder, Saudi National Bank, said it wouldn’t pour more money into the troubled institution.

Early Thursday, Credit Suisse said it intended to borrow up to $54 billion from the Swiss National Bank in what it called “decisive action” to boost its liquidity.

“This additional liquidity would support Credit Suisse’s core businesses and clients as Credit Suisse takes the necessary steps to create a simpler and a more focused bank built around client needs.” the flagship Swiss bank said in a statement.

On Wednesday, Suisse Group chairman Axel Lehmann had insisted that government assistance “isn’t a topic” for the embattled lender.dom

First Republic is one of several regional banks under pressure.Photo by Justin Sullivan/Getty Images

First Republic is one of several regional banks under pressure.Photo by Justin Sullivan/Getty Images

But Credit Suisse’s stock cratered to an all-time low shortly after admitted to finding “material weaknesses”in its financial reporting over the last two years. The Swiss bank has significant holdings in the US, raising concerns of further contagion.

The turmoil comes on the heels of credit rating agency Moody’s cutting its outlook for the banking system due to “rapid deterioration in the operating environment” following the failure of Silicon Valley Bank and Signature Bank.

SVB’s collapse sparked fears of a run on regional banks.AFP via Getty Images

SVB’s collapse sparked fears of a run on regional banks.AFP via Getty Images

Moody’s placed six regional banks on “downgrade” watch: First Republic, Zions Bancorp, Comerica, Intrust Financial, UMB Financial and Western Alliance.

Shares of San Francisco-based First Republic hovered in negative territory and were down 21% Wednesday. KeyCorp shares were down 3.5%.

Other regional banks seesawed, paring earlier losses and turning positive by midday. Western Alliance surged 8.3%%. Comerica rose 3.1%. But Zions Bancorp dropped 1.9%.

Charles Schwab’s stock was up 5.1% after CEO Walt Bettinger revealed a day earlier that he bought 50,000 shares in the firm.

Volatility has spiked this week for regional bank stocks — which plunged across the board on Monday only to bounce a day later. First Republic shares plunged nearly 70% to start the week before rallying on Tuesday.

Credit Suisse shares hit an all-time low this week.Getty Images

Credit Suisse shares hit an all-time low this week.Getty Images