(Yahoo) The media industry has been rocked this holiday season by news of newsroom layoffs as outlets downsize to combat volatility in advertising, after an already-brutal year of job cuts.

In the last month alone, Condé Nast, G/O Media, Vice Media and Vox Media have all cut staff, most of whom already had layoffs earlier this year. (Vice filed for bankruptcy in June.)

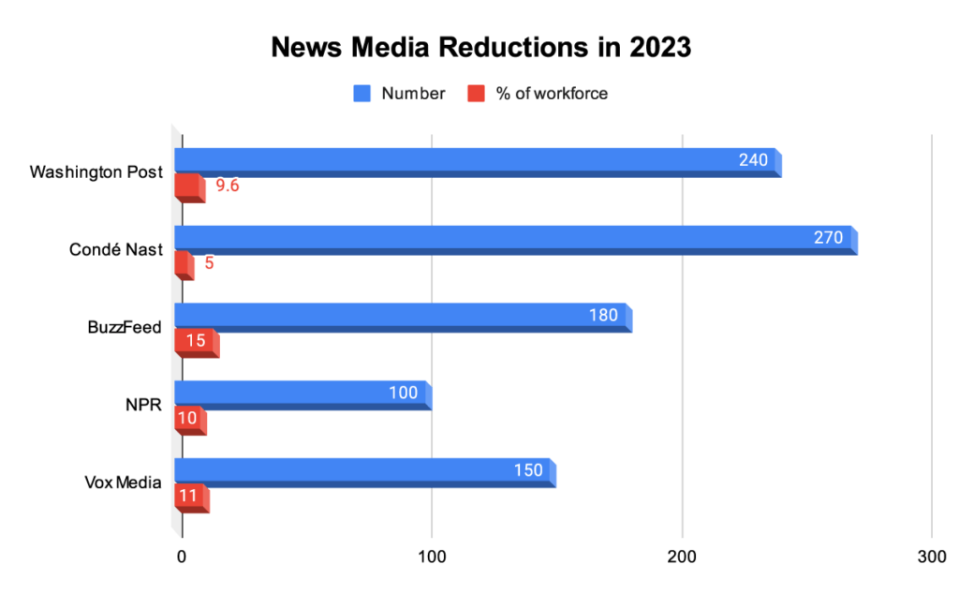

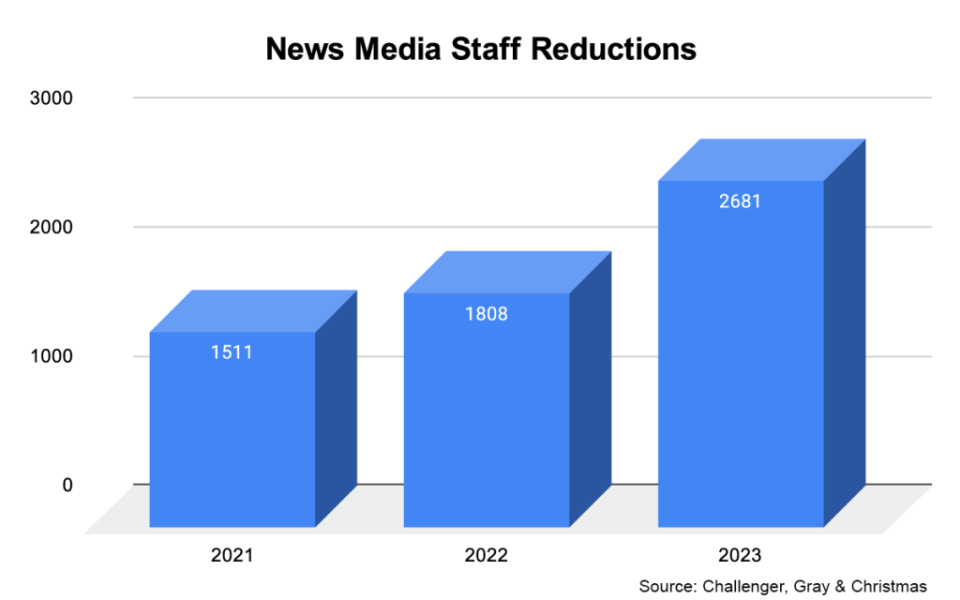

Broadcast, print and digital outlets collectively saw 2,681 journalism job cuts in 2023, up 48% from 1,808 in 2022 and 77% from 1,511 in 2021, according to a report from employment firm Challenger, Gray & Christmas.

“All available evidence suggests that the commercial future for journalism is especially dire,” Victor Pickard, a professor of media policy and political economy at the University of Pennsylvania’s Annenberg School for Communication, told TheWrap. “We cannot simply let the market drive local journalism into the ground. I expect to see more legislative efforts, especially at state government levels, aimed at shoring up and even expanding local journalism.”

To that end, one bright spot amid the gloomy outlook has been the growth of nonprofit newsrooms, which increased in number by 17% in 2022 and boosted revenues 19% to nearly $500 million between 2021 and 2022, according to a report published this May by The Institute for Nonprofit News.

Last week, Mother Jones and the Center for Investigative Reporting, two San Francisco based non-profit investigative organizations, said they were merging and would employ 70 staffers. The combined outlets have $21 million in funding commitments over the next three years, Monika Bauerlein, the CEO of Mother Jones, said in a statement.

“Community-based online media, and nonprofit media more broadly, have been relatively insulated from the layoff march,” Jesse Holcomb, an assistant professor of journalism and communication at Calvin University, told TheWrap. “Those newsrooms are often small, lean, and increasingly revenue diverse.”

Yet even some of them have felt the same industry pressures. In August, The Texas Tribune — an award-winning leader in the nonprofit journalism push — laid off 11 staffers, the outlet’s first job cuts in its 14-year history.

Advertising losses deepen

Heading into 2024, legacy media, which rely on digital and print advertising, are facing tough decisions about whether to cut staff or sell off unprofitable assets.

In November, G/O Media shuttered female-forward publication Jezebel after failing to find a buyer for the outlet, citing a lack of advertising traction for the site. The company laid off 23 editorial staffers, with Gizmodo and The Onion also impacted. In the announcement to staffers, CEO Jim Spanfeller cited challenging market conditions for the “very difficult decision” to trim the workforce. (Paste Magazine acquired Jezebel at the end of November and resumed publication)

Condé Nast said in early November it would reduce its staff by 5%, or around 270 employees. CEO Roger Lynch said the company is having to respond to digital advertising pressures and a decline in social media traffic, according to an internal memo. The job cuts, which officially began at the end of November, are impacting The New Yorker and other brands under the Condé Nast umbrella.

Underpinning the media slide is a darkening advertising outlook. U.S. newspaper publishers are expected to lose $2.4 billion in advertising investment between 2021 and 2026, mostly related to less print advertising, according to a 2022 report from the consulting firm PwC. Print advertising that fell to $7 billion in 2021 will drop to $4.9 billion by 2026, the consultancy said, with digital advertising growth only expected to increase by 1% in that same period — which is not enough to recoup overall lost ad revenue.

Traditional media outlets that still rely largely on ad revenue for income are now having to adjust strategies to “gain a wider reach,” Ashanti Blaize-Hopkins, the national president of the Society of Professional Journalists, told TheWrap.