From AttomData.com….

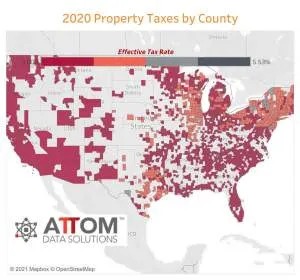

ATTOM Data Solutions, curator of the nation’s premier property database, today released its 2020 property tax analysis for almost 87 million U.S. single family homes, which shows that $323 billion in property taxes were levied on single-family homes in 2020, up 5.4 percent from $306.4 billion in 2019. The average tax on single-family homes in the U.S. in 2020 was $3,719 — resulting in an effective tax rate of 1.1 percent.

The average property tax of $3,719 for a single-family home in 2020 was up 4.4 percent from $3,561 in 2019 while the effective property tax rate of 1.1 percent in 2020 was down slightly from 1.14 percent in 2019.

The report analyzed property tax data collected from county tax assessor offices nationwide at the state, metro and county levels along with estimated market values of single-family homes calculated using an automated valuation model (AVM). The effective tax rate was the average annual property tax expressed as a percentage of the average estimated market value of homes in each geographic area.