From 100percentFedUp.com…

SAY WHAT…???!!!

For a year and a half, My Pillow CEO Mike Lindell has been called a liar, big box stores like Kroger, Bed Bath & Beyond, Kohls, Wayfair, and others have dropped his products from their stores over his claims that the voting machines in the 2020 election switched the votes causing Joe Biden to win the election illegally.

MI Constitutional attorney Matt DePerno, who hasn’t given up on his legal battle in Antrim County, MI, to prove voting machines have the ability to switch votes, has been demonized by Democrats, including the current Attorney General Dana Nessel, who Matt DePerno hopes to run against in the November 2022 election if he wins the nomination of the MI Republican delegates.

Yet incredibly today, while testifying in front of the Senate Rules and Administration Committee, FEC nominee Dara Lindenbaum, an election lawyer and former General Counsel to Stacey Abrams’ campaign, admitted to Senator Ted Cruz that she put her name on a legal document swearing that voting machines illegally changed votes from one candidate to another.

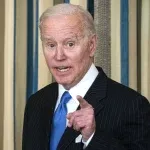

Joe Biden chose the former General Counsel to Stacey Abrams’ campaign to replace retiring Democratic Commissioner Steven Walther on the regulatory agency that enforces U.S. campaign finance law.

Sen. Ted Cruz to Biden nominee to the FEC: “As an officer of the court, you were willing to put your name on a legal pleading alleging that the machines used in Georgia in 2018 were switching votes illegally from one candidate to another. Is that correct?” Dara Lindenbaum: “Yes”

Sen. Ted Cruz to Biden nominee to the FEC: “As an officer of the court, you were willing to put your name on a legal pleading alleging that the machines used in Georgia in 2018 were switching votes illegally from one candidate to another. Is that correct?”

Dara Lindenbaum: “Yes” pic.twitter.com/Jv8bM95a87

— Steve Guest (@SteveGuest) April 6, 2022