(Gateway Pundit) Environmental, social and governance (ESG) investing is a favored strategy by woke companies focused on making the world “a better place.”

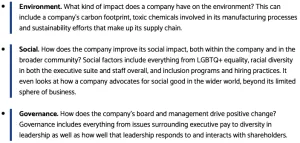

Forbes describes the criteria for the ESG strategy as:

BlackRock, Inc. is an American multinational investment management corporation and the world’s largest asset manager.

The company has embraced ESG and encourages portfolio companies to disclose their ESG data including carbon emissions and board diversity, among other criteria.

BlackRock’s woke strategy seems ironic considering their heavy investments with global polluter and the human rights crushing CCP run China.

Last December,William Hild, Executive Director of Consumers’ Research, sent a letter to the governors of the 10 states with the top 10 state pension funds invested with BlackRock.

Hild writes, “Later today, Consumers’ Research, the nation’s oldest consumer advocacy organization, will issue a Consumer Warning focused on the world’s largest money management firm, BlackRock. The warning is meant to raise awareness among American consumers that BlackRock is taking their money and betting on China. In so doing they are putting American security at risk, along with billions of dollars from U.S. investors, including many state-run pension plans. I wanted to make sure that you were aware that your state is one of the top ten states whose public pension funds are invested in BlackRock and, therefore, potentially at risk based on the issues we outline in our Consumer Warning.”

“For these reasons and more, Consumers’ Research wants to ensure you are aware of the risks associated with investing with BlackRock. We urge elected officials to do their due diligence in educating themselves and their staff on the multiple risks posed by BlackRock’s extensive investments in Chinese companies, both from an ethical standpoint as well as the fiduciary responsibility owed to U.S. pension holders and retirees. As the leader of a state whose pension funds are among the top ten most extensively invested in BlackRock, we invite you to examine our report and conduct any necessary efforts to learn more about the risks to the assets of your state’s public employees.”

In addition to Blackrock’s troubling heavy investments in China, their ESG focus has led the State of Florida to announce that it will pull $2 billion of its assets managed by the firm.

In a press release, Patronis said: