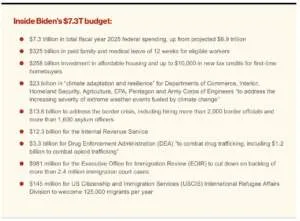

(New York Post) President Biden unveiled his election-year budget pitch Monday, calling for $5.5 trillion in tax increases by raising rates on the wealthy and corporations — while driving up spending by $7.3 trillion on defense, federal benefit programs, affordable housing and student debt cancellation, among other proposals.

The fiscal year 2025 budget — which is highly unlikely to be approved by Congress — matches last year’s topline tax increase level and spends $300 billion more while purportedly cutting the federal deficit by $3 trillion over the next 10 years, the White House said on Monday.

Fiscal hawks and Republicans alike were quick to call out the administration for the “reckless spending.”

The Committee for a Responsible Federal Budget (CRFB) noted the Office of Management and Budget (OMB) estimates project the national debt would surge to $45.1 trillion — or 105.6% of Gross Domestic Product (GDP) — by 2034 under the plan, up from $27.4 trillion.

Brian Riedl, a senior fellow at the Manhattan Institute focusing on the budget and taxes, told The Post on Monday that the president’s proposals would saddle the US with “the highest sustained income tax burden in American history as a share of the economy.”

“The president isn’t simply raising taxes to close the deficit, he’s raising it to expand government,” Riedl said after having called Biden’s budget last year “the highest peacetime burden in American history.”

In a Friday interview before the budget dropped, Riedl added that the proposals amount to “even bigger tax hikes down the road when it’s time to rein in the deficit.”

“The price tag of President Biden’s proposed budget is yet another glaring reminder of this Administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility,” House Speaker Mike Johnson (R-La.) and other GOP leaders said in a statement.

“While hardworking Americans struggle with crushing inflation and mounting national debt, the President would increase their pain to spend trillions of additional taxpayer dollars to advance his left-wing agenda.”

Biden, 81, floated some of his budget proposals during Thursday night’s State of the Union address, including raising the income tax rate for corporations to 28% and bringing the minimum corporate tax rate from 15% up to 21%.

He also called for more than $400 monthly in mortgage rate tax credits and a 25% tax on billionaires — defined as those with a net worth of $100 million or greater.

“You know, there are 1,000 billionaires in America. You know what the average federal tax is for these billionaires? They are making great sacrifices: 8.2%,” Biden said mockingly, adding that his tax hike would “raise $500 billion over the next 10 years.”

“Under my plan, nobody earning less than $400,000 a year will pay an additional penny in federal taxes,” he added. “Nobody. Not one penny. And they haven’t yet.”

The White House budget claims revenue from the new taxes would help prevent the insolvency of Medicare while paying for a $2,000 cap on prescription drugs and a $35 cap on insulin.

The Biden administration has repeatedly attacked congressional Republicans for supporting the 2017 Tax Cuts and Jobs Act under President Donald Trump, which it faulted for including “giveaways” to “wealthy and corporate tax cheats.”

However, most of those tax cuts will sunset by 2025 — leaving a “glaring black hole in the budget” and complicating Biden’s pledge to not raise taxes on Americans earning under $400,000 annually according to CRFB President Maya MacGuineas.

Making the tax cuts set by the Trump-era legislation permanent could cost the feds as much as $3 trillion — effectively negating any deficit reduction.

“The president is trying to have it both ways on the 2017 tax cuts,” said Riedl, who also said that Biden’s claims that the 2017 law largely benefited the rich have been “widely debunked” and argued the 8.2% tax rate was “essentially made up by White House economists.”

“They do not count the corporate and estate taxes paid by the wealthy, but they also expand their income to include all sorts of things like unrealized capital gains that will be taxed in a future year,” Riedl said.

“America has the most progressive tax code in the entire [Organization for Economic Co-operation and Development] and billionaires do not pay an 8% tax rate.”

Social Security will also be insolvent within a decade on its current pace, added MacGuineas, forcing cuts of 23% for all beneficiaries due to an immediate payout from the program’s trust funds.

Biden has also accused his predecessor of adding nearly $2 trillion to the deficit, a number Riedl noted included bipartisan COVID relief legislation.