(Yahoo) Sales of previously owned homes declined for the seventh straight month in August, as rising mortgage rates priced out more would-be buyers from the market. But the volume exceeded expectations.

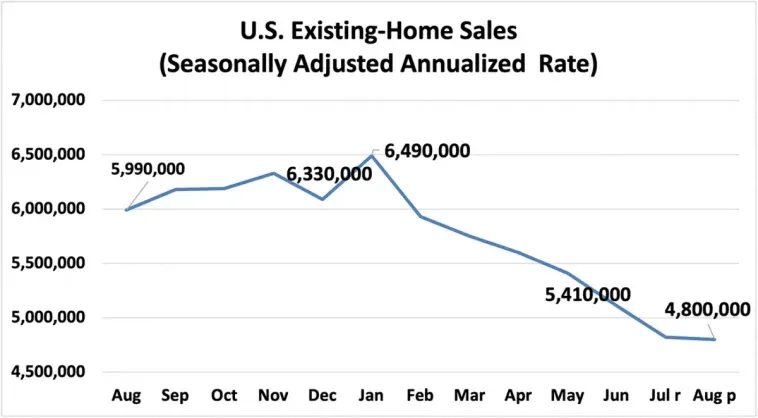

Contract closings fell 0.4% in August from July to a seasonally adjusted annual rate of 4.80 million, according to the National Association of Realtors (NAR). The median estimate called for 4.69 million in a Bloomberg survey of economists. Sales fell 19.9% from one year ago.

The figures underscore a slowing housing market as buyers face tougher conditions with mortgage rates rising, higher prices, and low inventory of homes — a result of a slowdown in construction and homeowners reluctant to list for sale.

“Even buyers able to afford a house at current rates could feel frozen, waiting for mortgage rates to fall dramatically again like they did from the end of June to mid-July, when rates dropped 50 basis points in just two weeks,” according to Zillow research.

Rates have nearly doubled in the last year and topped 6% last week for the first time since 2008. The steep rise in borrowing costs has pushed monthly mortgage payments for a newly purchased home from $897 in 2019 to $1,643 last month, an 83% jump from this time last year before the pandemic hit, Zillow reported.

Additionally, recent volatility in mortgage rates have also been a whiplash for borrowers, who are able to qualify for a loan one week but not the next.

The median listing price in August came in at $389,500, a 7.7% jump from a year ago, when the median listing price was $361,500 in 2021. While the figure marks the longest-running streak of year-over-year increases, it’s also the second straight month the median sales price fell from the previous month and is down $24,000 from the record high of $413,800 recorded in June, providing another sign of softness in the market.