(Daily Mail) House prices will plummet this year with San Jose, Austin, Phoenix, and San Diego staring down the barrel of 25% boom-to-bust declines, according to Goldman Sachs.

The Fed‘s ongoing inflation battle, which sent mortgage rates soaring from 3% to 7% in 2022, has throttled the housing market and sparked the biggest price correction since the 2008 crash.

Goldman warned investors in a research paper earlier this month titled, ‘Getting worse before getting better’, that housing markets were particularly overheated in the Southwest and Pacific Coast.

While Goldman’s outlook for the national housing market is less dire, with prices seen dropping 6% this year before rising next year, certain cities could see sharp declines in home valuations.

San Jose, Austin, Phoenix, and San Diego are projected to be stung with peak-to-trough declines of 25% that would rival the 2007-08 Global Financial Crisis which saw house prices plunge 27% nationwide.

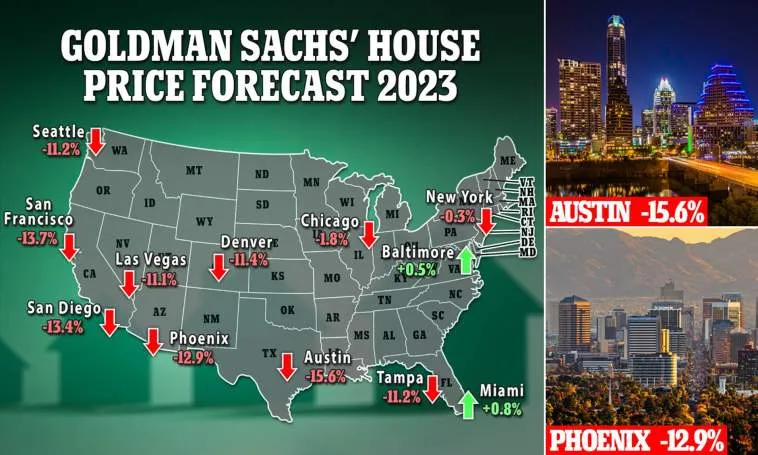

Goldman Sachs issued its 2023 projections for home valuations, predicting that overheated markets on the West Coast and Southwest will see sharp corrections

In 2023, Goldman is forecasting double-digit home price declines in key markets like Austin (-15.6%), San Francisco (-13.7%), San Diego (-13.4%), Phoenix (-12.9%), Denver (-11.4%), Seattle (-11.2%), Tampa (-11.2%), and Las Vegas (-11.1%).

Austin dropped 10.4% from its 2022 peak house price, meaning its boom-to-bust decline could be north of 25% as the trend continues into this year.

Milder price corrections are anticipated in the Northeast, Southeast, and Midwest.

The bank projects house prices to dip slightly in Chicago (-1.8%) and New York (-0.3%) in 2023.

Small increases are expected in Baltimore (+0.5%) and Miami (+0.8%) during the same period.

Overall, Goldman forecasts US house prices to fall by 6.1% this year. This would represent an aggregate peak-to-trough decline of roughly 10% in US home prices through the end of this year from June 2022.

Home prices in Austin (above) are projected to drop 15.6% this year, meaning its total decline from last year’s peak could be north of 25%