(ZeroHedge) Two weeks ago, we turned tactically bullish on US equities. Some investors felt this call came out of left field, given our well-established bearish view on the fundamentals.

To be clear, this call is based almost entirely on technicals rather than fundamentals, which remain unsupportive of many equity prices and the S&P 500 [ZH; similar to what Goldman said on Saturday]. The technical picture became more supportive, in our view, after the historic reversal two weeks ago on another higher-than-expected CPI reading for September.

More specifically, the S&P 500 gapped lower that Thursday morning, only to reverse 6% and close at the highs. Then, on Friday, stocks had a terrible day, with the S&P 500 trading down 2.4% and closing on the lows. When we studied this price action over the following weekend, we found that Friday’s pullback was a 61.8% Fibonacci retracement of Thursday’s rally that stopped right at the 200-week moving average. The combination of these technical oddities was too much to ignore. Hence, our tactical/technical rally call.

From a fundamental standpoint there are some supportive factors too.

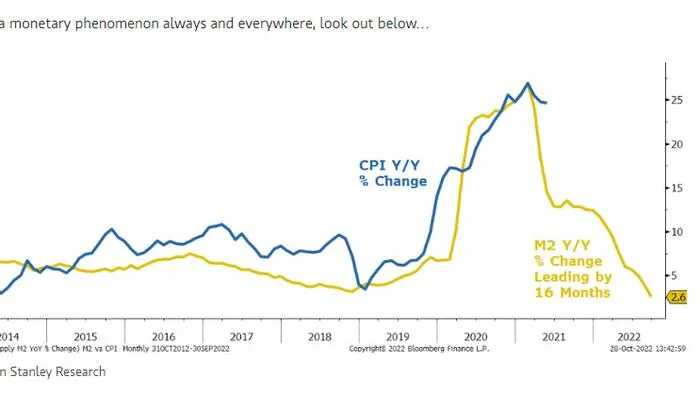

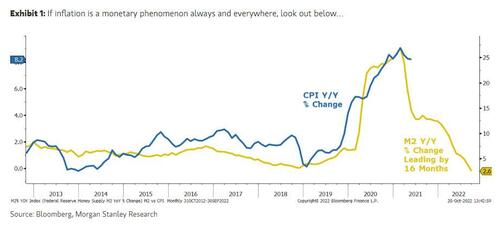

First, CPI is coming down. Granted, it is one of the most backward-looking data series; it says very little about the future and can be misleading about present conditions. Think back to what CPI was telling us at the end of March 2021. The index sat at 2.6%Y after the government had delivered more than $3 trillion in fiscal stimulus during 1Q21. As a result, the money supply (M2) was growing by 27%Y. Never in the history of these data (70+ years) had M2 grown at even half that rate. Given that inflation is always and everywhere a monetary phenomenon, it was crystal clear that 2.6%Y inflation was likely to explode higher. Fast forward to today and CPI stands at 8.2%Y, a 40-year high and marginally below its peak of 9.1%Y in June.

However, M2 is now growing at just 2.5%Y and falling fast. Given the leading properties of M2 for inflation, the seeds have been sown for a sharp fall next year. The implied fall in CPI outlined in Exhibit 1 would be highly out of consensus, and while it won’t necessarily play out exactly as in our chart, we believe it’s directionally correct. This has implications for Fed policy and rates. Indeed, part of our call for a rally assumes we are closer to a pause/pivot in the Fed’s tightening campaign, and while we don’t expect to see a dramatic shift at next week’s meeting, the markets have a way of getting in front of Fed shifts. In short, investors may be as offside on inflation today as they were in March 2021, just in the opposite direction.

One of the reasons why we did not try to trade the summer rally was that we felt it was much too early to be thinking about a Fed pivot. We turned out to be right as the Fed shift proved to be too far in the future to make the summer rally last. We’re closer today because M2 growth is fast approaching zero and the 3-month-10-year yield curve finally inverted last week, something Chair Powell has noted is important in determining if the Fed has done enough.