(CNBC) Reddit shares jumped 48% in their debut on Thursday in the first initial public offering for a major social media company since Pinterest hit the market in 2019.

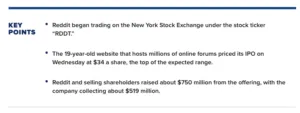

The 19-year-old website that hosts millions of online forums priced its IPO on Wednesday at $34 a share, the top of the expected range. Reddit and selling shareholders raised about $750 million from the offering, with the company collecting about $519 million.

The stock opened at $47 and reached a high of $57.80, marking a 70% increase at its peak for the day. It closed at $50.44, giving the company a market cap of about $9.5 billion.

Trading under the ticker symbol “RDDT,” Reddit is testing investor appetite for new tech stocks after an extended dry spell for IPOs. Since the peak of the technology boom in late 2021, hardly any venture-backed tech companies have gone public and those that have — like Instacart and Klaviyo last year — have underwhelmed. On Wednesday, data center hardware company Astera Labs made its public market debut on Nasdaq and saw its shares soar 72%, underscoring investor excitement over businesses tied to the surge in artificial intelligence.

At its IPO price, Reddit was valued at about $6.5 billion, a haircut from the company’s private market valuation of $10 billion in 2021, which was a boom year for the tech industry. The mood changed in 2022, as rising interest rates and soaring inflation pushed investors out of high-risk assets. Startups responded by conducting layoffs, trimming their valuations and shifting their focus to profit over growth.

Reddit’s annual sales for 2023 rose 20% to $804 million from $666.7 million a year earlier, the company detailed in its prospectus. The company recorded a net loss of $90.8 million last year, narrower than its loss of $158.6 million in 2022.

Based on its revenue over the past four quarters, Reddit’s market cap at IPO gave it a price-to-sales ratio of about 8. Alphabet trades for 6.1 times revenue, Meta has a multiple of 9.7, Pinterest’s sits at 7.5 and Snaptrades for 3.9 times sales, according to FactSet.

In addition to those companies, Reddit also counts X, Discord, Wikipedia and Amazon’s Twitch streaming service as competitors in its prospectus.

Reddit is betting that data licensing could become a major source of revenue, and said in its filing that it’s entered “certain data licensing arrangements with an aggregate contract value of $203.0 million and terms ranging from two to three years.” This year, Reddit said it plans to recognize roughly $66.4 million in revenue as part of its data licensing deals.

Google has also entered into an expanded partnership with Reddit, allowing the search giant to obtain more access to Reddit data to train AI models and improve its products.

Reddit revealed on March 15 that the Federal Trade Commission is conducting a nonpublic inquiry “focused on our sale, licensing, or sharing of user-generated content with third parties to train AI models.” Reddit said it was “not surprised that the FTC has expressed interest” in the company’s data licensing practices related to AI, and that it doesn’t believe that it has “engaged in any unfair or deceptive trade practice.”

Reddit was founded in 2005 by technology entrepreneurs Alexis Ohanian and Steve Huffman, the company’s CEO. Existing stakeholders, including Huffman, sold a combined 6.7 million shares in the IPO.