From FoxBusiness.com….

The coronavirus pandemic dealt an unforeseen blow to many industries, leaving Americans out of work and without pay. The federal government started a number of financial assistance programs, like increased unemployment benefits and stimulus checks, as well as putting evictions on hold during the pandemic. But as the economy rumbles back to its pre-pandemic state, these protections are set to expire.

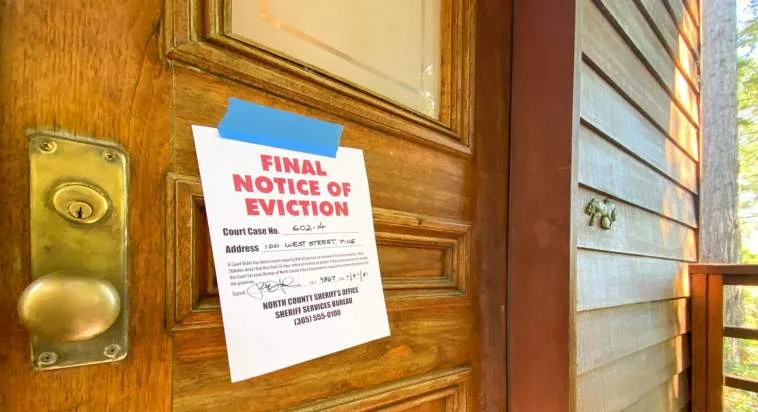

The CDC has issued a final extension to the eviction moratorium, giving tenants until July 31, 2021, to get their finances back on track. And about half of the states have cut off the additional unemployment benefit of $300 before the Sept. 6 expiration date, hoping to motivate people back into the workforce.

Still, many consumers are still behind on rent and struggling to make ends meet as we recover from the impact of COVID-19. If you want to get your household expenses back on track, you’re probably looking for ways to cut your spending.

There are several ways to cut spending without having to sacrifice necessities like utility bills or food costs. You may be able to save hundreds of dollars every month by: