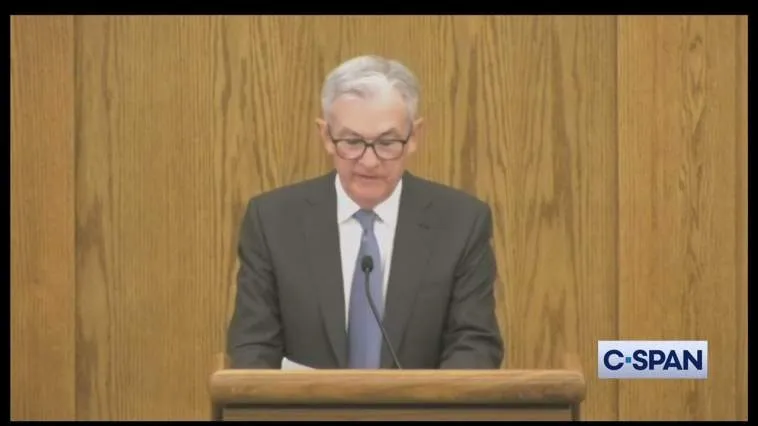

(USA Today) Stocks experienced a vicious sell-off Friday, prompted by Fed Chairman Jerome Powell’s undeniably hawkish comments about the likely need for aggressive interest rate hikes to lower inflation.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” Powell said during a speech in Jackson Hole, Wyoming. “These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

Markets initially took his brief remarks in stride but losses accelerated as the day went on.

The Dow Jones Industrial Average closed down 1,008 points, or 3%. The S&P 500 closed down by 141 points or 3.37%. The index is on track for its biggest monthly loss in two months. While the tech-heavy Nasdaq Composite saw the steepest decline of 498 points or 3.9%.

Hawkish Fed

“He basically said there will be pain and that they won’t stop and can’t stop hiking until inflation moves a lot lower,” said Brian Jacobsen, senior investment strategist at Allspring Global Investments. “It was a mercifully short speech and to the point. Powell didn’t really break new ground, which is good since Jackson Hole isn’t a policy meeting.”

Expectations built through the week that Powell would try to bat down recent talk about a “pivot” by the Fed. Such speculation had helped stocks surge through the summer.

Some investors speculated that the Fed could cut interest rates in 2023 as pressures on the economy mount and the nation’s high inflation hopefully recedes.

But Powell’s speech made clear that the Fed will accept weaker growth for a while to get inflation under control, analysts said. “Powell reiterated that the Fed is worried about rising prices, and getting inflation under control is emphatically job number one,” said Jeff Klingelhofer, co-head of investments at Thornburg Investment Management.

Perhaps giving some hope to investors, some analysts said Powell seemed to indicate expectations for future inflation aren’t taking off. If that were to happen, it could cause a self-perpetuating cycle that worsens inflation.

Personal consumption expenditures price index

For now, the debate on Wall Street is whether the Fed will raise short-term rates by either half a percentage point next month, double the usual margin, or by three-quarters of a point. The Fed’s last two hikes have been by 0.75 points, and a slight majority of bets on Wall Street are favoring a third such increase in September, according to CME Group.

A report Friday morning showed that the Fed’s preferred gauge of inflation decelerated last month and wasn’t as bad as many economists expected. It’s a potentially encouraging signal, which may embolden more of Wall Street to say that the worst of inflation has already passed or will soon.

Other data showed that incomes for Americans rose less last month than expected, while consumer spending growth slowed.

Following the reports and Powell’s comments, the two-year Treasury yield rose to 3.39% from 3.37% late Thursday. It tends to track expectations for Fed action.