(Not The Bee) At some point if you max out all your credit cards, the lenders will stop sending you new ones. When that happens, not only does the spending spree end, you either have to pay off your debt, or you have to declare bankruptcy if you’re unable to pay.

Considering that our government charged $1.5 trillion to its credit card over the last 4 months, and another $1.5 trillion over the next six months; you have to wonder when the credit will run out.

And there are signs that it is on its way.

Yesterday, the federal government issued 30-year treasuries to quickly borrow $24 billion dollars.

Our usual lenders China, Japan, Saudi Arabia, and Russia didn’t show up, and 25% of the debt had to be bought by the primary dealers on Wall Street, the buyers of last resort.

Of course, they demand a bigger yield on investment than foreign governments do. Meaning we’ll be paying more in interest via our taxes.

And even with the bigger yield, those dealers are saying that there’s no way they can keep backing the volume of debt that the government wants to borrow.

Plus who wants to buy bonds today, if the yield is going to be higher tomorrow?

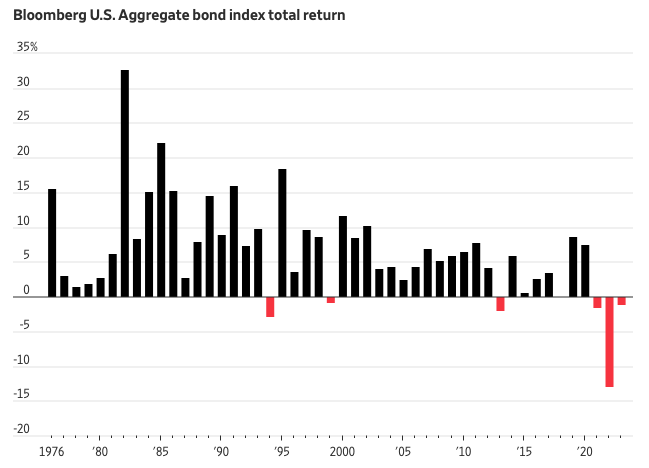

The “safe” bond market, where most retirees were told to put their 401Ks and other investments after 65, is on track for its 3rd consecutive year of losses.

Something that has never happened before.