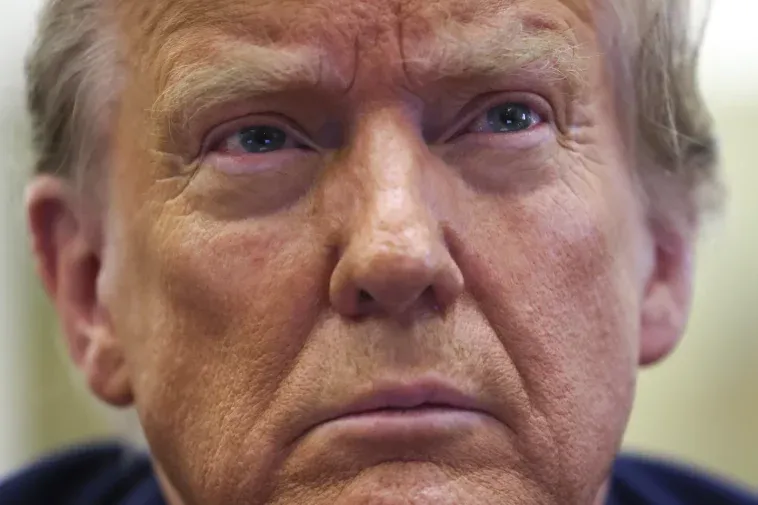

(AP) Within days, Donald Trump could potentially have his sprawling real estate business empire ordered “dissolved” for repeated misrepresentations on financial statements to lenders, adding him to a short list of scam marketers, con artists and others who have been hit with the ultimate punishment for violating New York’s powerful anti-fraud law.

An Associated Press analysis of nearly 70 years of civil cases under the law showed that such a penalty has only been imposed a dozen previous times, and Trump’s case stands apart in a significant way: It’s the only big business found that was threatened with a shutdown without a showing of obvious victims and major losses.

Lawyers for the state in Trump’s monthslong civil trial have argued that the principles of fair play in business alone are enough to justify a harsh penalty, but even they aren’t calling for the prospect of liquidation of his businesses and properties raised by a judge. And some legal experts worry that if the judge goes out of his way to punish the former president with that worst-case scenario, it could make it easier for courts to wipe out companies in the future.

“This is a basically a death penalty for a business,” said Columbia University law professor Eric Talley. “Is he getting his just desserts because of the fraud, or because people don’t like him?”

AP’s review of nearly 150 reported cases since New York’s “repeated fraud” statute was passed in 1956 showed that nearly every previous time a company was taken away, victims and losses were key factors. Customers had lost money or bought defective products or never received services ordered, leaving them cheated and angry.

What’s more, businesses were taken over almost always as a last resort to stop a fraud in progress and protect potential victims. They included a phony psychologist who sold dubious treatments, a fake lawyer who sold false claims he could get students into law school, and businessmen who marketed financial advice but instead swindled people out of their home deeds.

In Trump’s case, his company stopped sending exaggerated financial figures about his net worth to Deutsche Bank and others at least two years ago, but a court-appointed monitor noted that was only after he was sued and that other financial documents continued to contain errors and misrepresentations.

And though the bank offered Trump lower interest rates because he had agreed to personally guarantee the loans with his own money, it’s not clear how much better the rates were because of the inflated figures. The bank never complained, and it’s unclear how much it lost, if anything. Bank officials called to testify couldn’t say for sure if Trump’s personal statement of worth had any impact on the rates.

“This sets a horrible precedent,” said Adam Leitman Bailey, a New York real estate lawyer who once successfully sued a Trump condo building for misrepresenting sales to lure buyers.

Added University of Michigan law professor William Thomas, “Who suffered here? We haven’t seen a long list of victims.”

‘DISSOLUTION’ OF AN EMPIRE?

Trump, the Republican presidential frontrunner, has focused his ire at potentially losing his business at both the Democratic New York attorney general who brought the case and the judge presiding over it.

In an order last September that’s currently under appeal, State Supreme Court Judge Arthur Engoron said Trump had indeed committed fraud and should have the state certificates needed to run many of his New York companies revoked. He said Trump should then be stripped of control over those companies, which are the official owners of his Fifth Avenue headquarters and other marquee properties, and have them turned over to a receiver who will manage the “dissolution” of them.

What the judge left unclear is what he meant by “dissolution,” whether that referred to the liquidation of entities that control properties or the properties themselves. Asked specifically in court whether Trump’s buildings would be literally sold off as in a bankruptcy, Engoron said he would clarify at a later date.

In a worst case, as interpreted by legal experts, Engoron could decide dissolution means stripping the real estate mogul of not only of his New York holdings such as Trump Tower and his 40 Wall Street skyscraper, but his Mar-a-Lago club in Florida, a Chicago hotel and condo building, and several golf clubs, including ones in Miami, Los Angeles and Scotland.

For her part, New York Attorney General Letitia James has asked that Trump be banned from doing business in New York and pay $370 million, what she estimates is saved interest and other “ill-gotten gains.” But she never asked for a property sale and may not even want one. Said one of her lawyers, Kevin Wallace, in his closing argument, “I don’t think we are looking for anything that would cause the liquidation of business.”

Engoron has indicated that within the next couple of weeks he will issue a ruling expected to decide on the cash penalty and business ban and clarify his “dissolution” order.

A HISTORY OF PUNISHMENTS

Notably, New York’s anti-fraud statute, known as Executive Law 63(12), is clear that a finding of fraud does not require intent to deceive or that anyone actually gets duped or loses money. The attorney general must only show “repeated fraudulent or illegal acts.”