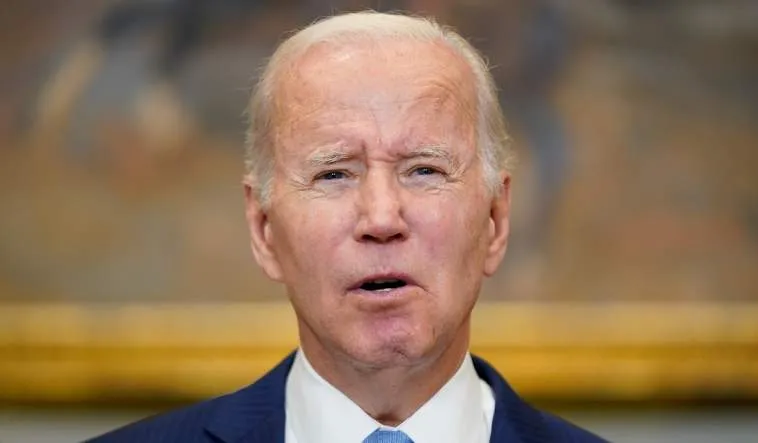

(Townhall) After President Joe Biden said this week that he would veto any attempt by Congress to protect Americans’ retirement savings from ending up tied to woke ESG — environmental and social governance — obsessed entities, U.S. Senator John Barrasso called the president out for giving the “middle finger to middle-class Americans.”

Saying “Republicans are committed to protecting American families’ retirement savings,” Barrasso slammed Biden for his lack of concern for Americans “who are concerned about the returns of their retirement funds.” The president, Barrasso explained, remains “more committed to his climate change agenda and his pipedream than he is to the American dream of hundreds of millions of American families.”

Pointing to the “woke and weaponized bureaucracy at the Department of Labor” that “has come out with new regulations on retirement funds” which would put such investments under control of the “very liberal, left-wing agenda” pursued under the banner of ESG.

The Labor Department’s rule would allow (if not push) private retirement account fiduciaries to consider a company’s policies on climate change, for example, as part of their investment decisions rather than a stock’s profitability or return on investment over time — decisions that impact some 150 million Americans.

As Barrasso explained, that means Americans “can’t invest in things that you might want to invest in, including oil and gas and coal and American energy,” Barrasso continued.

Republicans are committed to protecting American families’ retirement savings. Yesterday @JoeBiden said he is going to veto our efforts. Joe Biden is giving the middle finger to middle class Americans who are concerned about the returns on their retirement funds. pic.twitter.com/KFfmHWPhdr

— Sen. John Barrasso (@SenJohnBarrasso) February 28, 2023

“The reality is the investments that the Democrats are now mandating are things that don’t actually turn out to be good investments,” Barrasso explained. “Bloomberg analysts looked at this and said the return on those ESG investments falls behind the market.”

Indeed, there have been several stories at Bloomberg explaining how “Big ESG Funds Are Doing Worse Than the S&P 500” and “Why ETF Returns Trail Wider Market,” plus “ESG Funds Seen Underperforming Broader Market in 2023” according to a survey.

“So, people that invest in those fall further and further behind,” Barrasso continued. “And not only are their investment returns worse, but the cost of making those investments – the expenses – are much higher. So people end up losing twice,” he added.

House Republicans successfully passed a resolution to kill the Labor Department’s new ESG-supporting rule by a vote of 216-204, and Barrasso explained that he hopes the Senate “will soon be voting to overturn these mandates” as well in order to “stop Joe Biden from strangling American families’ investments in their retirement funds.”

“The American people deserve more freedom and choice than we’re getting from this control and command Biden administration,” he concluded.

Senate GOP Leader Mitch McConnell (R-KY) tweeted on Tuesday that the Senate would vote on the resolution to kill the Labor Department rule to stop “another Democrat attack on families’ finances.”