(CNBC) “A diamond is forever,” but perhaps not for the increasing number of consumers spurning the gemstone for lab-grown counterparts, gold and even other colored gemstones.

The slogan was coined by diamond giant De Beers in 1948, capturing the impression of security and romance. But not all relationships withstand the test of time.

The company’s largest shareholder Anglo American plans to divest De Beers as as it restructures its business after rejecting a takeover bid from BHP. Anglo American CEO Duncan Wanblad told the Financial Times that selling De Beers will be “the hardest part” of the company’s radical restructuring.

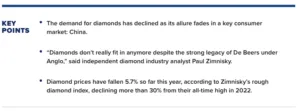

“Diamonds don’t really fit in anymore despite the strong legacy of De Beers under Anglo,” said independent diamond industry analyst Paul Zimnisky.

“Anglo is ultimately going to do what its shareholders want, and it seems they want to focus on a longer-term strategy of commodities that support the green infrastructure buildout, for example copper,” he told CNBC.

Dwindling diamond demand

The demand for diamonds has declined as its allure fades in a key consumer market: China.

Falling marriage rates as well as growing popularity for gold and lab-grown gems all drove down Chinese demand for diamonds, said market research firm Daxue Consulting. The end of pandemic restrictions also saw consumers channeling their spending toward travel experiences instead of diamond products.

Diamond prices have fallen 5.7% so far this year, according to Zimnisky’s rough diamond index, declining more than 30% from their all-time high in 2022.

De Beers once commanded a monopoly on the diamond market, but its share has fallen. Economic conditions led the company to cutting prices by 10% at the start of the year, Bloomberg reported citing sources.

“Last year was a much tougher period for the [diamond] industry as economic challenges, a post-Covid lull in engagements and a growth in supply of lab-grown diamonds all affected demand conditions,” Anglo American’s head of communications, Marcelo Esquivel, told CNBC.

The preference for lab-grown diamonds also plays a critical role in driving down prices of natural diamonds, said Ankur Daga, founder and CEO of fine jewelry e-commerce company Angara.

“The core issue is the rapid growth of lab-grown diamonds,” he said. Daga added that in the U.S., which is the largest consumer of diamonds, half of engagement ring stones will be lab grown this year, up from just 2% in 2018.

Lab-grown diamonds, which can be up to 85% cheaper than natural diamonds, are made in a controlled environment using extreme pressure and heat. The process recreates how natural diamonds are forged deep in the Earth’s mantle. Lab-grown diamond sales surged from just 2% of the global diamond jewelry market in 2017 to 18.4% in 2023, according to data provided by Zimnisky.

Additionally, the case for buying diamonds as an investment has dwindled, Daga said. Diamonds were seen as an asset and inflation hedge over the last 50 years, he elaborated. But that investment rationale has largely faded as prices plunge.

An industry ‘in trouble’

“The diamond industry is in trouble,” Daga told CNBC, adding that he believes natural diamond prices could fall another 15%-20% over the next 12 months.