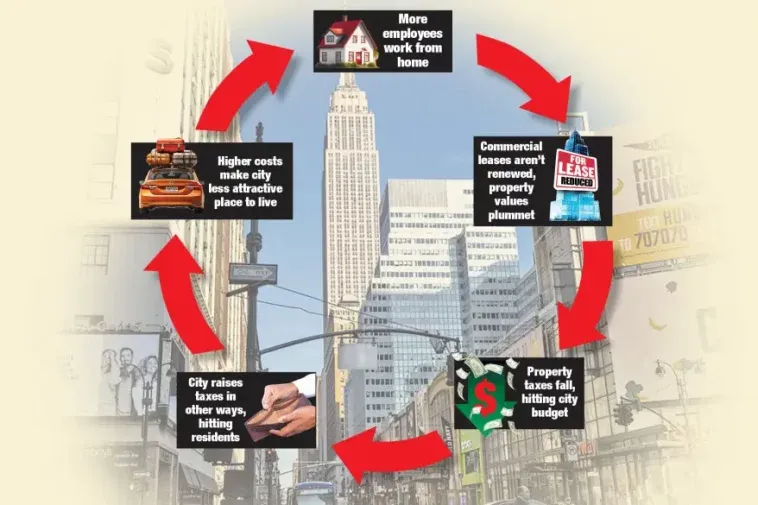

(New York Post) Empty office buildings have set New York on an “urban doom loop” that will destroy the quality of life in the city and drive residents out.

That is the conclusion of a team of economists from NYU Stern Business School, Columbia Business School and the National Bureau of Economic Research.

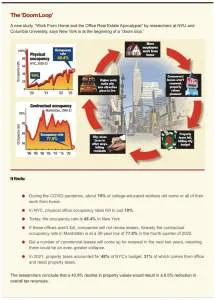

Many employees who worked from home during the pandemic haven’t returned — at least not full time. In 2020, office occupancy fell from nearly 90% to 10%. But it’s only bounced back to 48.4% in New York.

In response, fewer companies are renewing their leases, which lowers the value of office buildings.

The number of newly signed lease, meanwhile, fell from 285.4 million feet per year before the pandemic to only 62.4 million feet per year in the same period after.

The researchers developed a valuation model that tells us how much these properties will be worth in six years’ time — a level of destruction that would make the Four Horsemen blush.

Already between December 2019 and December 2022, the economists show, lease revenue fell 18.5% in inflation-adjusted terms.

Lower values means less tax revenue. In the case of New York, the paper predicts a 6.5% drop by 2029. To plug the hole, cities will raise taxes and fees in other ways — making the city less attractive to live in, which means even less revenue.

The study’s authors highlight that vacancy rates are at 30-year highs in many American cities — New York’s vacancy rate is 22.2% in 2023’s first quarter.Alamy Stock Photo

The study’s authors highlight that vacancy rates are at 30-year highs in many American cities — New York’s vacancy rate is 22.2% in 2023’s first quarter.Alamy Stock Photo

The authors — Arpit Gupta of the NYU Stern School of Business; Vrinda Mittal of the Columbia Business School; and Stijn Van Nieuwerburgh of the Columbia University Graduate School of Business — argue this has already begun.

Gotham is in the grips of the death cycle.

Offices becoming ghost towns

The study’s authors highlight that vacancy rates are at 30-year highs in many American cities — New York’s vacancy rate is an eyewatering 22.2% in 2023’s first quarter.

Rents are almost sure to fall even further than they already have.

Prices are certain to follow rents down the drain.

Some properties are hit worse than others. The economists find the properties in the highest rental tier fare a lot better than those lower down the pile.

The reason for this, they say, is employers can only persuade their employees to come to work if the digs are nice. If you can’t afford the best of the best, it is more likely your employees would prefer to work in their spare room.

The model the researchers use to figure out how much value is going to be wiped off the commercial real-estate market is a very clever piece of work. Not only does the model look at market rent, supply and vacancy dynamics, but it also tries to capture the scale of work-from-home by studying stocks that benefit from changes in the workplace, like Zoom, and those that were hurt by them, like airlines.

With the model in hand, the economists can project what office buildings will be worth out to 2029.

Even if things gradually return to normal and people come back to the office, the valuations of New York City office buildings will fall 43.9% by that year. This is because of the massive losses on rental revenue the owners will take as things get back to normal.

The office valuation apocalypse

What does this mean for office property values overall? They get absolutely nuked.

The economists estimate the value of office stock in New York City has fallen by around $69.6 billion by the end of 2022. Owners of commercial property can only play ostrich and bury their heads in the sand for so long. At some point they will have to eat these losses.

New York isn’t the only metropolis that will experience the disaster. The economists expect the San Francisco market to lose around $32.7 billion in value, while Charlotte will lose $5.1 billion. This would be a decline in office values of 61.6% for San Francisco and 33.7% for Charlotte even if work-from-home gradually disappears.

Looking down the list, all urban America looks like it is going deeply in the red. The authors calculate that nationwide the United States will see a $506.3 billion decline in commercial property values. That puts losses at just over half a trillion dollars!

Urban America deeply in the red

Just when you thought it couldn’t get any worse, it gets worse.

The economists point out that cities rely on property-tax revenues for much of their budget. New York City’s budget is currently around $107 billion, and around $35 billion of that comes from property. San Francisco’s much smaller budget of $6.2 billion also relies heavily on real estate, with around $2 billion coming from property taxes.

The researchers estimate it would reduce tax revenues by around 6.5% in New York City.

Services are cut. Taxes across the board go up. And more people flee as the city becomes even more uninviting.

New York City, together with many other urban centers, experiences Detroitification.