(CNBC) Stocks tumbled Friday to cap a brutal week for financial markets, as surging interest rates and foreign currency turmoil heightened fears of a global recession.

The Dow Jones Industrial Average tumbled 486.27 points, or 1.62%, to 29,590.41. The S&P 500 slid 1.72% to 3,693.23, while the Nasdaq Composite dropped 1.8% to 10,867.93.

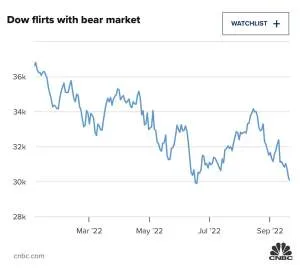

The Dow notched a new low for the year and closed below 30,000 for the first time since June 17. The 30-stock index ended the day 19.9% below an intraday record, flirting with bear market territory. At one point, the Dow was down more than 826 points.

The major averages capped their fifth negative week in six, with the Dow giving up 4%. The S&P and Nasdaq shed 4.65% and 5.07%, respectively. It marked the fourth negative session in a row for stocks, as the Fed on Wednesday enacted another super-sized rate hike of 75 basis points and indicated it would do another at its November meeting.

“The market has been transitioning clearly and quickly from worries over inflation to concerns over the aggressive Federal Reserve campaign,” said Quincy Krosby of LPL Financial. “You see bond yields rising to levels we haven’t seen in years — it’s changing the mindset to how does the Fed get to price stability without something breaking.”

The British pound hit a fresh more than three-decade lowagainst the U.S. dollar after a new U.K. economic plan that included a slew of tax cuts rattled markets that are fearing inflation above all right now. Major European markets lost 2% on the day.

“This is a global macro mess that the market is trying to sort out,” Krosby said.